We are back, recharged and ready to lend

We finished off December with one of our largest months of lending to date. Thank you to our brokers for an amazing 2019, it’s only possible with your support.

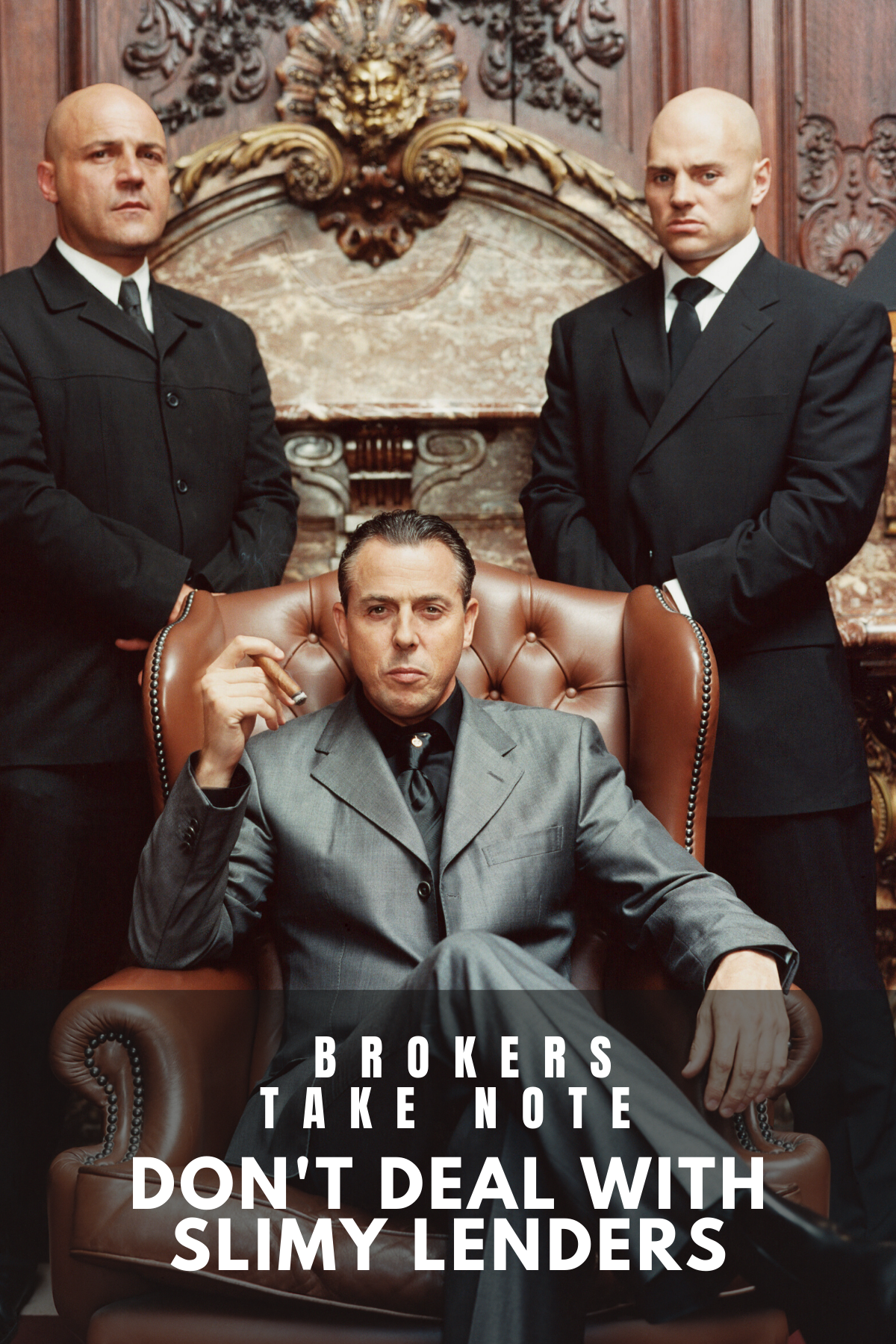

Ok it’s time to get back to my pet peeve. Slimy private lenders.

Read More

Tags:

Urgent Finance,

Short term finance,

short term loan,

the secured lending difference,

liquidation

Private Lending School

Lesson 3: Speed of Funding - How to Determine the Reality of "Fast" Funding

So you need a fast funding solution? Most of the funders in this space seem to promise exactly that, so how do you work out how long a funder is actually going to take? It’s all about asking the right questions and doing your homework.

Read More

Tags:

Urgent Finance,

Short term finance,

short term loan,

the secured lending difference,

limited access in funding,

banks closed,

liquidation,

partly completed development

Private Lending School

Lesson 3: Speed of Funding - How to Determine the Reality of "Fast" Funding

So you need a fast funding solution? Most of the funders in this space seem to promise exactly that, so how do you work out how long a funder is actually going to take? It’s all about asking the right questions and doing your homework.

Read More

Tags:

Short term finance,

short term loan,

the secured lending difference,

limited access in funding,

banks closed

Private Lending School

Lesson 2: Interest Rates - All that glitters is not gold

Lesson 1 I focused on term sheets. This post I will focus on interest rates and costs.

This topic hit home to me this week when a broker called me about a deal and asked me to price a loan, which I did, to which he called me and said "I have a cheaper option".

Read More

Tags:

Short term finance,

short term loan,

the secured lending difference,

limited access in funding,

banks closed

My last post struck a chord it would seem. I received lots of messages from brokers sick of the games that are often played in the private loan industry.

Who would of thought #removethescumfromprivatelending could get such a response.

The questions that I was asked following the post and the obvious increase of brokers entering this space suggested to me more education is needed. So over the next posts I will unpick this world for you that will hopefully assist you navigate it safely.

Read More

Tags:

Short term finance,

short term loan,

the secured lending difference,

limited access in funding,

banks closed

There is so much noise in the media about the impacts of the Royal Commission on the Bank’s appetites and the resulting flow through effects to the property market that for some it can be difficult to know where the hype ends and reality begins.

Much like our feathered friends in a coal mine, reading the early indicators are essential for survival in such a volatile market.

Read More

Tags:

Short term finance,

short term loan,

the secured lending difference,

limited access in funding,

banks closed

What are the most important attributes in a short term lender?

Speed and reliability is what brokers are telling us and for these reasons they keep coming back to Secured Lending.

Read More

Tags:

Urgent Finance,

Short term finance,

short term loan

Partly completed site – finished thanks to Secured Lending.

A Melbourne based developer had some cost over runs on a partially complete development site and needed a cash injection of $1,250,000 to meet such costs.

Read More

Tags:

Urgent Finance,

Short term finance,

short term loan,

partly completed development

We advanced $3 million to refinance a Private Lender.

We were approached by a broker as his Client’s existing loan was due to expire in a week.

Notwithstanding earlier representations, the Client was advised by the Lender ‘the investor wants their money back’ (read: we are going to charge you default interest). Both the Client and the Broker knew that if the loan defaults, they will be charged with large default fees and interest.

Read More

Tags:

Urgent Finance,

Short term finance,

short term loan

.png)

.png)