We are back, recharged and ready to lend

We finished off December with one of our largest months of lending to date. Thank you to our brokers for an amazing 2019, it’s only possible with your support.

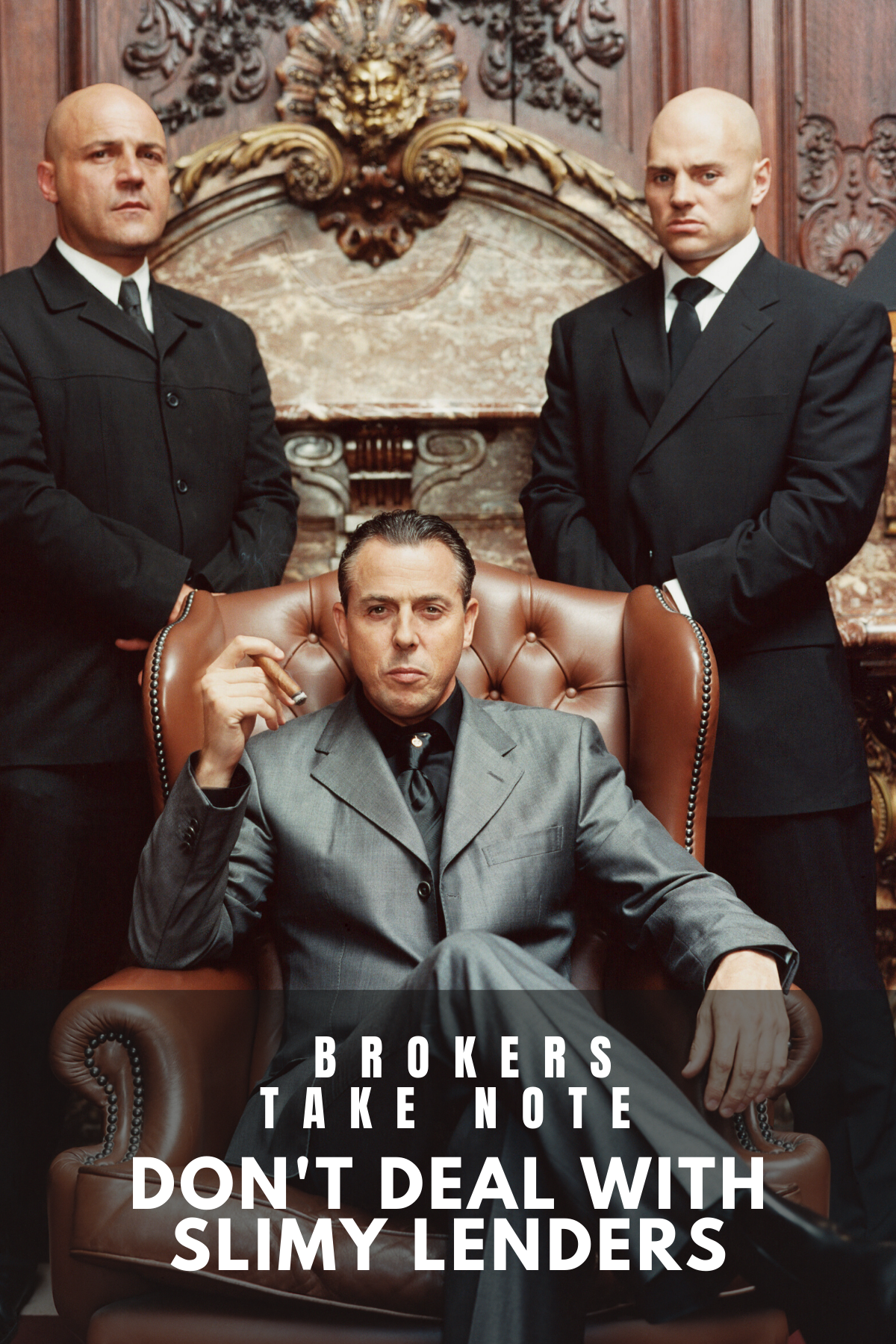

Ok it’s time to get back to my pet peeve. Slimy private lenders.

Read More

Tags:

Urgent Finance,

Short term finance,

short term loan,

the secured lending difference,

liquidation

Private Lending School

Lesson 3: Speed of Funding - How to Determine the Reality of "Fast" Funding

So you need a fast funding solution? Most of the funders in this space seem to promise exactly that, so how do you work out how long a funder is actually going to take? It’s all about asking the right questions and doing your homework.

Read More

Tags:

Urgent Finance,

Short term finance,

short term loan,

the secured lending difference,

limited access in funding,

banks closed,

liquidation,

partly completed development

What a crazy month it's been here at Secured Lending! It seems like the current demand for private commercial funding has picked up (and in full force) as we have been inundated with loan applications from our ever expanding referral network.

So what have we recently funded in the current crazy funding markets...

Read More

Tags:

Working Capital,

Urgent Finance,

ATO,

opportunity,

the secured lending difference,

Construction Finance

What are the most important attributes in a short term lender?

Speed and reliability is what brokers are telling us and for these reasons they keep coming back to Secured Lending.

Read More

Tags:

Urgent Finance,

Short term finance,

short term loan

Partly completed site – finished thanks to Secured Lending.

A Melbourne based developer had some cost over runs on a partially complete development site and needed a cash injection of $1,250,000 to meet such costs.

Read More

Tags:

Urgent Finance,

Short term finance,

short term loan,

partly completed development

It has been a crazy week here at Secured Lending. We have come across Borrowers from all walks of life who are looking to tidy up their finances in preparation for the end of financial year.

With a new settlement every day for the past 7 days, how could we not take the opportunity to bring you 7 LOANS IN 7 DAYS

Read More

Tags:

Working Capital,

Urgent Finance,

Delayed Settlement,

ATO,

opportunity,

the secured lending difference

We advanced $3 million to refinance a Private Lender.

We were approached by a broker as his Client’s existing loan was due to expire in a week.

Notwithstanding earlier representations, the Client was advised by the Lender ‘the investor wants their money back’ (read: we are going to charge you default interest). Both the Client and the Broker knew that if the loan defaults, they will be charged with large default fees and interest.

Read More

Tags:

Urgent Finance,

Short term finance,

short term loan

We were approached to fund a company which had received a winding up application from the Taxation Office.

Secured Lending stepped in and funded the Company secured against the Company’s commercial property and the Director’s investment property.

Read More

Tags:

Urgent Finance,

Short term finance,

short term loan

This client came to us in despair.

The builder had walked off site and trades were owed money, the developer was inexperienced and didn’t have a plan or new builder to finish the build.

The client had wasted months talking to other lenders who promised the world and delivered nothing.

Read More

Tags:

Urgent Finance,

Short term finance,

short term loan

See how Secured Lending helps clients during tax time

This is the time of the year where the two quarterly Activity Statements are due in quick succession followed by Company Tax Returns for the FYE 2017. We are seeing more clients getting caught out on this and in need of a short term loan.

Read More

Tags:

Urgent Finance,

outstanding tax debt,

Short term finance,

short term loan

.jpg)

.png)